Ethiopia Ushers in New Financial Era with Historic Securities Exchange Launch

Addis Ababa, July 11, 2025 (FMC)— Ethiopia has marked today a pivotal moment in its financial sector with the official listing and commencement of trading of Government Treasury Bills on the newly established Ethiopian Securities Exchange (ESX).

This landmark event, celebrated by key financial institutions, signals a new era of market-based financing, enhanced transparency, and broader investor participation driven by years of strategic reforms under the Homegrown Economic Reform Agenda.

During the occasion, Finance Minister Ahmed Shide underscored the profound significance of the achievement.

“The success we celebrate today is the result of many years of reform work, policy coordination, and the commitment of both the government and the private sector.”

According to him, the listing of government securities on the ESX is a crucial step in modernizing the government’s financial system and strengthening the reform efforts initiated over the past six years.

Investors have been asking for this for a long time, the Minister noted, adding that the development creates credibility and expands new investment opportunities.

On his part, National Bank of Ethiopia (NBE) Governor Mamo Mihretu pointed out the capital market’s vital role in the national economic growth.

“The capital market is to grow alongside other sectors and serve as an alternative source of finance for our country’s economic growth,” he stated.

The Governor elaborated that the ESX will contribute to price stability and serve as a key aid in the effort to enhance the effectiveness of monetary policies and modernize operations.

This development provides an opportunity for the government to address budget deficits in a market-driven, non-inflationary manner, thereby facilitating national development and helping to predict and control long-term financial supply, he added.

Finance State Minister Eyob Tekalign described the launch as the culmination of seven years of reform.

While individual reforms may have seemed disparate, today’s event demonstrates that all these reform efforts are now yielding significant results, he said.

The state minister expressed the shift to market-based borrowing, even at potentially higher interest rates, was a deliberate, albeit not easy, decision to move away from monetary financing of the treasury and foster sustainable economic growth in a healthy macroeconomic environment.

Eyob confirmed the government’s commitment to zero monetary financing for the treasury, a policy contributing to the highest export numbers and significant reserves.

On the occasion, the Ethiopian Capital Market Authority (ECMA) Director-General Hana Tehelku said today’s milestone reflects the authority’s unwavering commitment to building a transparent, inclusive, and robust capital market that will foster sustainable economic growth.

Since its establishment in 2022, ECMA has been instrumental in laying the legal and regulatory foundations for the capital market.

It has issued crucial directives on securities issuance, investor protection, market conduct, and the licensing of market participants, providing a robust framework for market operations.

Formed as a public-private partnership under the Capital Market Proclamation No. 1248/2021, the ESX has developed a secure and modern trading platform capable of accommodating both debt and equity instruments.

Since October 2024, it has also been facilitating inter-bank money market operations in collaboration with the NBE and commercial banks, it was learned.

ESX CEO Tilahun E. Kassahun said on his part that “the first listing of government securities on ESX marks the beginning of a new chapter for a very promising debt market in Ethiopia.”

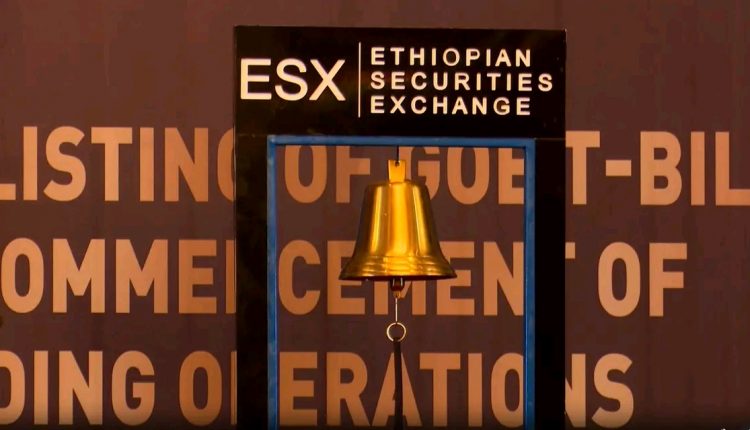

Today’s ceremonial bell-ringing signified the official commencement of securities trading on the ESX, marking a significant stride in Ethiopia’s journey toward establishing a dynamic and inclusive capital market.

This launch represents a pivotal advancement in building a resilient financial system that will support Ethiopia’s economic transformation for generations to come, ENA reported.